Our take on the stimulus. A note from Tipping Point Chief Program Officer, Kelly Bathgate:

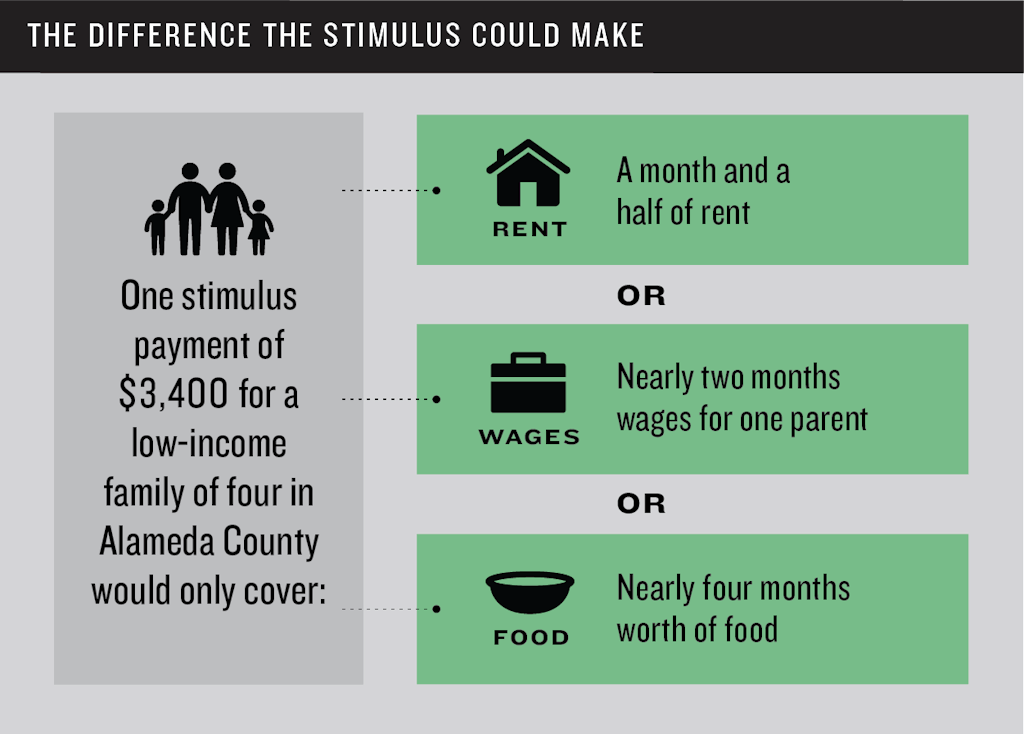

Over the past couple of weeks, we have seen the value of flexible philanthropic dollars in getting cash to those who need it, quickly. Soon, we will see the impact of government dollars at scale. As stimulus payments begin to appear in millions of bank accounts around the country this month, countless families can breathe a sigh of relief. But for many low-income Bay Area households, that relief will be harder to come by.

Using data from our own research, we estimate that 10-15% of low-income households—those who need the extra cash the most—will miss out on the stimulus payments. These families aren’t required to file their taxes because their household income is less than $24,400, making access to stimulus payments a lot harder. As many as 110,000 households could miss out on payments of $1,200 for every adult and $500 for every child in the household. And, if family of four at the poverty line doesn’t file, they’ll also be missing out on receiving existing tax credits like the Earned Income Tax Credit (EITC) and Child Tax Credits, which would total$6,413.

In April 2020, in an effort to ensure as many people as possible gained access to these cash payments, we leveraged existing partnerships and government initiatives:

Filing taxes gives low-income families access to more than just this stimulus payment, but to other existing tax credits as well. Prior to COVID-19, our partnership with the Economic Security Project was focused on increasing the uptake of the EITC as it has proven to be one of the most effective anti-poverty interventions in American economic policy. Yet, the current EITC lets too many Americans –and Californians –fall through the cracks. This partnership is now even more critical—by increasing the number of low-income workers filing taxes, more workers will be able to access federal and state tax credits an ongoing basis, while also making them eligible for this type of one-time payment in the future.

Our partnership with Code for America, which began earlier this year, was initially a pilot to get 1,500 low-income people in the Bay Area to file their taxes online through Volunteer Income Tax Assistance (VITA) sites. Code for America estimates that 20% of people who could qualify for poverty-fighting payments, like the EITC, don’t file taxes and therefore miss out, leaving upwards of $10 billion on the table nationwide.

The pilot launched in early March but since then, the situation has drastically changed. In-person VITA sites have closed, and the federal stimulus package was announced, heightening the importance of getting low-income families to file.

In the past month, Code for America has increased the reach of their pilot, now projecting that they will support 5,000-10,000 Bay Area residents to file their taxes. The impact could be huge. For example, a single parent with one child living on $10,000 a year would receive the following if they filed: $3,400 in federal EITC, $254 in California EITC, $1,125 in Child Tax Credit, and $1,700 in federal stimulus—a total of $6,479.

Long-time Tipping Point grantees:

Mission Asset Fund and Canal Alliance are helping to get cash to those who are not eligible for stimulus, unemployment benefits, or paid sick leave. Mission Asset Fund is providing $500 cash grants to undocumented college students, and Canal Alliance has already distributed $293,000 to 834 families, with checks to 300 families still to be processed.

Supporting people experiencing homelessness

Our Chronic Homeless Initiative has engaged its Community Advisory Board and grassroots organizations to ensure people experiencing homelessness can register online and overcome any other barriers to accessing their payment.

THE NUMBERS